Sanctions Search

Sanctions Search a product brought to you by Professional Office Ltd

Welcome to Sanctions Search

If you have any questions, please contact us on: 0843 713 0 777

|

||||

| Solicitors | Estage and lettings agents | Financial advisers | Mortgage brokers | Currency exchange |

| Insurance market | Recruitment consultants | Banks | Retailers | Accountants |

Click Here to Register for an Account

Anti-Money Laundering – International Financial Sanctions – Politically Exposed Persons & Adverse Media - Identity Verification Tools Document Fraud Analysis – Company Credit Reports – DBS Criminal Records Screening

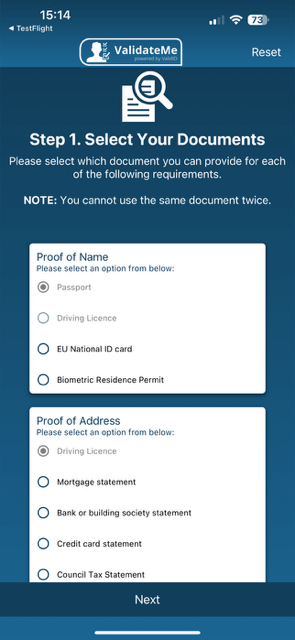

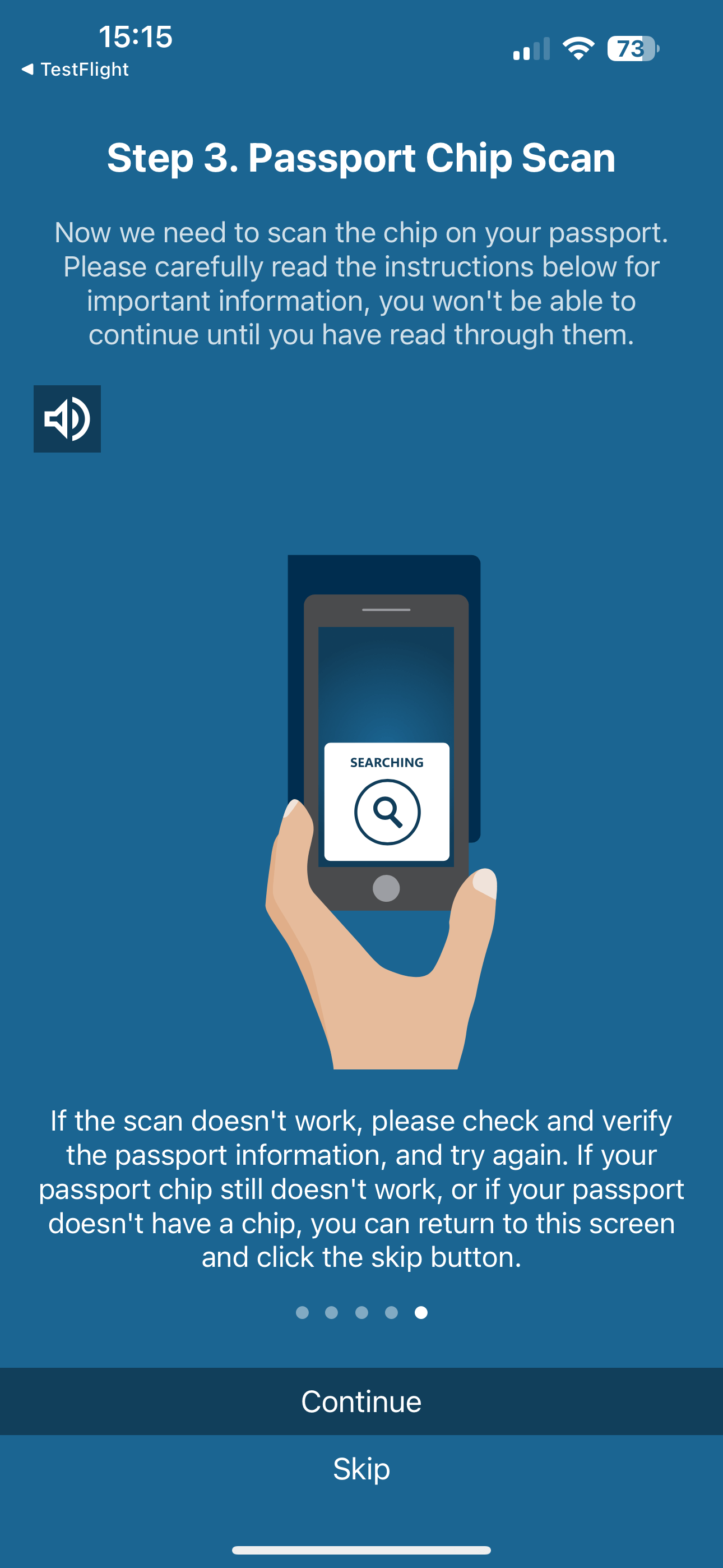

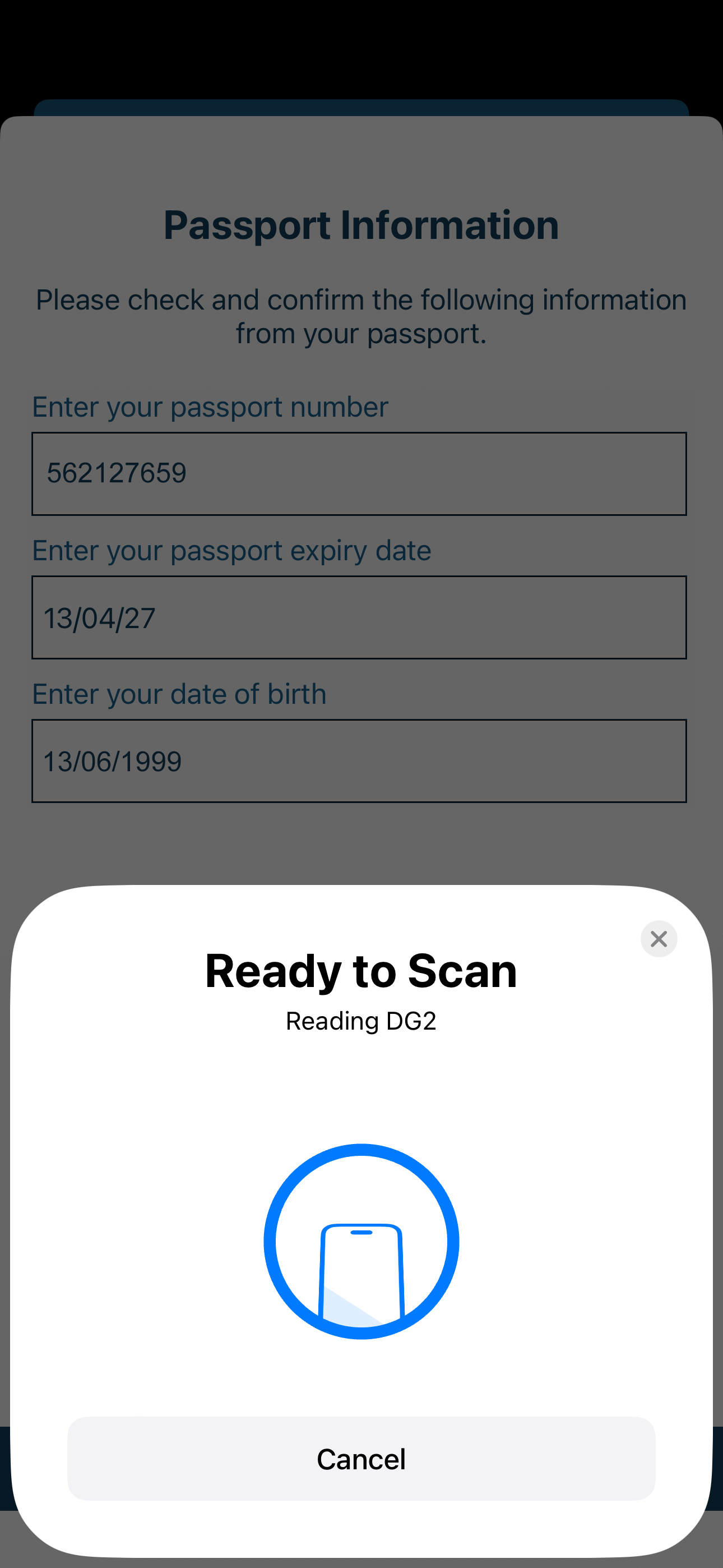

**July 17 2024 sees the release of the update to ValidateMe© which verifies passport chips globally**

Your Trusted Source for International Sanctions & AML screening

Navigating the complex world of international sanctions is now easier than ever. At SanctionsSearch.com, we provide a powerful, user-friendly platform to help you quickly and accurately determine if individuals, entities are subject to any government or international sanctions.

Why Choose SanctionsSearch.com?

- Comprehensive Database: Access a centralized and up-to-date repository of global sanctions lists.

- Efficient Searches: Conduct thorough searches with ease, ensuring your business remains compliant with international regulations.

- User-Friendly Interface: Our platform is designed with simplicity and efficiency in mind, making it accessible for all users.

- Reliable Information: Trust in our detailed and accurate data to make informed decisions.

- Cost Effective: From a minimal annual membership fee and a pay as you use model, our fees never break the bank

- Market Leading Technology: From simple to use interfaces through to passport chip scanning, and a constant update schedule, the system is always meeting the demands of AML Compliance

Who Can Benefit?

- Compliance Professionals: Ensure your organisation adheres to all applicable sanctions.

- Financial Services Companies: Needing to maintain regulatory compliance

- Legal Firms: Quickly & robustly verify the status of individuals or entities.

- Estate Agents: Running AML on sellers and buyers along with ID verification for tenants.

- Accountancy: From the large ACCA firms down to the bookkeeper with a handful of clients the system scales to your needs

- Recruitment: Reducing the chance of employment fraud is about reputational risk ValidateMe© makes this a thing of the past.

- Businesses: Protect your operations by avoiding prohibited transactions or associations.

Stay compliant and informed with SanctionsSearch.com. Start your search today and navigate international sanctions with confidence.

Click Here to Register for an Account

Back to the top